Autonomous Vehicles

| Transportation | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

| Sectors | Transportation | |||||||||||||||||||||||||

| Contact | Wilfred Pinfold | |||||||||||||||||||||||||

| Topics |

| |||||||||||||||||||||||||

Activities

Press

| ||||||||||||||||||||||||||

- Authors

In the last few years, there has been a major shift in the outlook for autonomous vehicles, not just in the headlines, but with investment and a serious development effort from almost every player in the auto and industrial technology industries.

It has become clear that a significant trend has now made its way into a full commitment from stakeholders. Predictions on the future size of the autonomous industry have ranged from the billions to the hundreds of billions of dollars. Contributing technologies such as sensors, navigation, location services and positioning software have all matured just enough to have autonomous vehicles reach road testing stage with success.

In the last few years, there has been a major shift in the outlook for autonomous vehicles, not just in the headlines, but with investment and a serious development effort from almost every player in the auto and industrial technology industries. It has become clear that a significant trend has now made its way into a full commitment from stakeholders. Predictions on the future size of the autonomous industry have ranged from the billions to the hundreds of billions of dollars. Contributing technologies such as sensors, navigation, location services and positioning software have all matured just enough to have autonomous vehicles reach road testing stage with success.

Autonomous vehicles are a key component of the “transportation as a service” vision of the future. Its advantages in providing greater safety, efficiency, cost-effectiveness and flexibility drive its development. It will be easier to provide more economically viable transportation solutions and products while being more sensitive to environmental concerns and complying with or exceeding existing environmental laws. In addition to those factors, its potential enabling of a large eco-system built around connected technologies to improve user experience, reduce congestion and environmental impact, build on lucrative software, media and infotainment market spaces contribute to the perfect storm of motivating drivers behind autonomous vehicles.

Urban areas wanting to transform into smart cities see the potential of urban speed electric transport as the energy-responsible, efficient and connected public transport vehicle of the future.

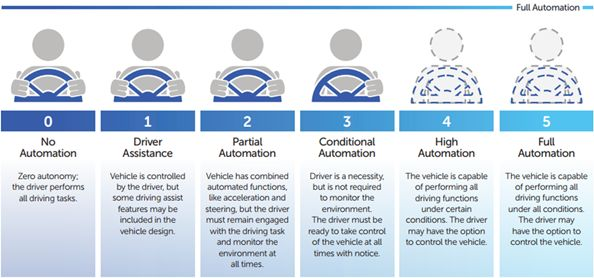

Not All Autonomous Vehicles Are Driverless

Although the term “Autonomous” has become synonymous with “driver-less”, it is only the last category, Level 5 Autonomous, that can do away with the driver altogether. As defined by the SAE International standard , adopted by the USDOT, there are six levels of Automation for Driving:

Autonomous operations are being developed for all vehicle form-factors from passenger vehicles to buses, shuttles, freight carriers, long-haul trucks, industrial equipment and cargo movers. They include high-speed as well as urban speed vehicles.

Most modern cars have some level of driver assistance such as sensor information, ABS brakes, collision detection, vehicle vicinity mapping, and even collision avoidance (the vehicle automatically brakes to avoid a collision without requiring the driver). Cruise control has been available on many cars and trucks for a long time. With a tremendous increase in the capabilities of the software stack

present in modern cars, greater automation and sophisticated control and monitoring are becoming easier and cheaper.

Fully Autonomous Capabilities - Open Road and Controlled Environments

Autonomous vehicles operating without a driver (Level 4 and Level 5) require at least the ability to determine the location of the vehicle, determine and follow a route to a destination, determine immediate obstacles and potential collisions in the vicinity of the vehicle and take steps to safely move forward or stop as needed. They also require the ability to navigate on open roads, follow routes, obey street signs and traffic signals, coexist with other vehicles on the road, perform operations such as turns and lane changes, and comply with all traffic laws. The level of redundancy, safety, performance and data handling required to deliver these capabilities means complex and software and advanced hardware and sensors. These technologies are still in the early stages of development and maturity.

When fully autonomous vehicles are operated in strictly controlled environments (Level 4) such as on special lanes and on private campuses the software and hardware required is simpler, cheaper and easier to test and produce. Manufacturers can use simpler location technologies and do not need the complexity and risk management of street navigation, with its high liability and complex performance requirements. Such use cases are more likely to be deployed much earlier than with full Level 5 autonomy.

Autonomous Vendors

There are several categories of providers of autonomous vehicles and components. At a high-level, we observe three distinct types of vendors:

- Full solution vendors: Vehicle + all the software and other hardware necessary (integrated solution).

- Autonomous software stack only: Vendors who provide an autonomous software stack to hardware (vehicle) manufacturers (these include closed, proprietary solution providers as well as open source solution providers).

- Component providers: Vendors who provide only autonomous components (whether software or hardware).

A survey of the industry shows that the above are made up of:

- Traditional auto manufacturers: Almost every automaker is performing research and development into autonomous vehicles, and is converting their current offerings into autonomous-capable versions. Most expect to have an autonomous vehicle on the road by 2020-2025.

- Traditional Suppliers: Quite a few have transitioned into providing or planning to provide autonomous versions of their components. These include hardware and software, ECU suppliers, by-wire programmable units such as by-wire-brake controllers, etc.

- Autonomous Software Suppliers: Companies who provide a full autonomous software solution to deploy on any vehicle (with certain hardware requirements).

- Autonomous Component Suppliers: New companies like Mobileye who are industry leaders in deploying sensors for localization and positioning, Quanergy, a LIDAR (Laser RADAR) supplier, etc.

Related industries and tech companies moving into the autonomous vehicle provider business: Companies such as Google, Uber, Lyft have entered the autonomous vehicle provider market. Ride-sharing companies like Uber and Lyft need such vehicles for their future fleet. Tech companies such as Google and Apple have entered the market because of their software skills. Google is road-testing their own autonomous vehicles while Apple has said they will be providing a full autonomous software solution to their partner manufacturer companies.

Two important points should be understood from this list:

- There are many options for deploying robust commercial last mile solutions today. These solutions can address city objectives on sustainability, safety and equity without any new innovations.

- Any legislation should recognize that these technologies exist and all efforts should be be made to deploy them rather than constructing legislation that would delay this deployment.

Now let's look at the promise of full autonomy, or National Highway Traffic Safety Administration (NHTSA) level 5 autonomy. NHTSA considers this to be complete driver replacement in all situations including off road. Many in the general public believe this technology is just around the corner. It is not. However, deployment in the urban environment with limited usage is possible today with legislative support.

Currently for ride services such as Uber and Lyft approximately 80% of the operating cost is for the driver. This cost puts these services out of reach of many low income families. For first mile last mile solution to be equitable we must reduce the cost per ride. We believe Level 4 autonomous (driverless) operation in controlled environments will meet the needs of first mile last mile transit without the risk, time and cost required to develop level 5.

We intend to conduct trials of these technologies to assess readiness for addressing selected sustainable, vision zero and equity goals and intends to conduct a set of trials in districts that introduce the public to these vehicles and learn how people respond.