India Stack

| India Stack | |

India Stack | |

| Team Organizations | National Payments Corporation of India Reserve Bank of India Reserve Bank Information Technology |

| Point of Contact | Wilfred Pinfold |

| Participating Municipalities | Mumbai India |

| Sectors | Data |

| Initiative | |

| Status | Development |

| Last Updated | January 29, 2026 |

Summary

India Stack is the moniker for a set of open APIs and digital public goods that aim to unlock the economic primitives of identity, data, and payments at population scale.

- Challenges

The Aadhaar project has been hampered by implementation errors, leading to hardship and financial loss for some of India’s most vulnerable citizens. The press has published reports of starvation due to difficulties in accessing the public food distribution system, as well as instances of fraud and data breaches. Some errors are inevitable in large projects, but failsafe mechanisms and measures designed with empathy for the marginalized (like extending enrollment periods and keeping old systems running for those having trouble accessing the new ones) are essential.

- Major Requirements

The core principles of India Stack is to lower the cost of transactions so that 1.3 billion people get access to socially and economically important services and that those services can be delivered by the private as well as public sector. It enables private innovation on the back of public infrastructure.

- Performance Targets

- Standards, Replicability, Scalability, and Sustainability

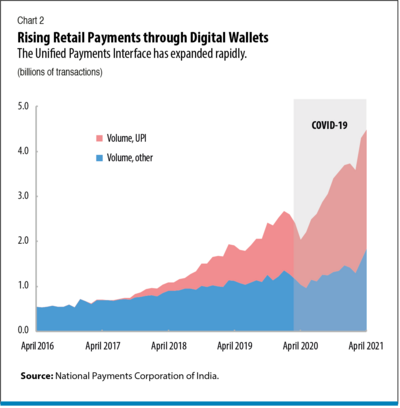

India Stack created a set of open protocols or standards that are implemented by the institutions concerned. This has opened up the private sector to innovate in the case of authentication services such as Aadhaar, digital signing of a document, facilitating payments and sharing data with consent.

- Cybersecurity and Privacy

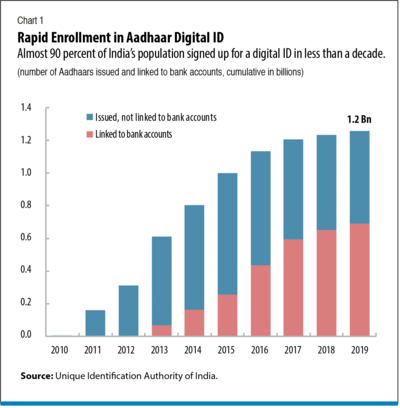

The centerpiece of India’s financial system is Aadhaar, a national ID. In less than seven years, 1.1 billion Indians have been issued an ID number after having their fingerprints and retinas scanned and stored in what is now the world’s largest biometric database. Aadhaar pays for itself by saving the government from making duplicate benefits payments or payments to deceased individuals. ID theft can be reduced by use of this unique ID number, verified by fingerprints or a retina scan. While it is asserted by the Indian government that state-of-the-art security protects the Aadhaar database, centralizing vast quantities of identity information guarantees the database will be an attractive target for cybercriminals who would like nothing more than to commit ID theft on an unprecedented scale.

- Demonstration/Deployment

To test all 4 layers- Presenceless, paperless, cashless and consent- of India stack, the India Stack team partnered with the largest FinTech alternative credit company in India, Capital Float in 2016.[9] The objective of the pilot was to provide loans to customers in a few minutes and in the comfort of their own house. Additionally, the target customer was someone with no collateral and limited data trail. When a user opened the application, he/ she had to give consent for Capital Float to access his/ her data through the digital platform (Consent). Once the consent was given Capital Float used the Aadhaar infrastructure to authenticate the users (presenceless). The Aadhaar also helped with e-KYC, a mandatory requirement for all loan activities in India. Once the authentication was complete, Capital Float pinged the Aadhaar data base to check for banking activity, and also used a mobile scraping technique to gather data from the customer's phone. These two steps helped Capital Float estimate the credit-worthiness of the customer. Once this was determined, the customer of the application saw loan offers on the screen. The customer could then select the offer and do an e-signature within the comforts of their home (paperless). This whole process could be completed in 45 seconds. Once the loan was approved it could directly be disbursed into the bank account of the customer (Cashless). The pull function of the UPI platform could also be utilized by Capital Float to get back the loan payments.

After the Pilot, the India Stack team has approached other alternate lenders to utilize the platform to give loans to under-served populations. Capital Float is already in the process of expanding the pilot in to a full-fledged service offering. This pilot proved a clear value proposition of the India Stack platform for the FinTech industry.